Are you considering outsourcing your bookkeeping tasks but not sure where to start?

This comprehensive article will delve into the world of outsourced bookkeeping services. From the different types of services available to the benefits and risks involved, we will cover everything you need to know.

Discover why businesses outsource their bookkeeping, how it can save you time and money, and how to select the right service provider.

Stay tuned to uncover all the ins and outs of outsourced bookkeeping!

What Are Outsourced Bookkeeping Services?

Outsourced bookkeeping services involve delegating a business’s financial recording, tracking, and management tasks to external professionals or agencies specialised in accounting and finance. This allows small businesses to focus on their core operations while ensuring accurate financial management.

These services play a crucial role in supporting small businesses by handling crucial financial functions such as payroll processing, tax preparation, and financial statement generation. By entrusting these tasks to expert bookkeepers, small businesses can access timely and reliable financial information, which is essential for making informed decisions. Outsourced bookkeeping services enable small businesses to operate more efficiently by streamlining their financial processes and ensuring compliance with regulations and tax requirements. This ensures that the business’s financial operations run smoothly and effectively.

What Are The Services Included In Outsourced Bookkeeping?

Outsourced bookkeeping services typically include maintaining financial records, preparing financial reports, budgeting, and forecasting for small businesses.

These services play a crucial role in ensuring a company’s financial health and stability. By delegating tasks to a specialised team, small businesses can concentrate on their core functions and strategic growth endeavours.

Financial record-keeping ensures that all transactions are accurately recorded and organised, while report generation provides valuable insights into the company’s performance. Budget planning helps allocate resources effectively, while financial forecasting aids in making informed decisions about future expansion and investment opportunities.

Why Do Businesses Choose To Outsource Bookkeeping?

Businesses outsource bookkeeping services to leverage the benefits of cost-effectiveness, scalability, and improved efficiency, enabling them to focus on core operations and facilitate business growth.

Outsourcing bookkeeping allows companies to reduce operational costs significantly by eliminating the need to hire full-time, in-house accountants. By entrusting this task to experienced professionals, businesses can benefit from the expertise and specialised knowledge that outsourcing firms offer. Outsourcing provides a scalable solution, allowing companies to adjust services based on their current needs, thereby avoiding the expenses of maintaining an in-house team. This flexibility saves money and frees up internal resources, enabling better utilisation in areas crucial for business expansion.

What Are The Benefits of Outsourcing Bookkeeping?

Outsourcing bookkeeping offers benefits such as increased accuracy, regulatory compliance, enhanced data security, improved operational efficiency, and streamlined financial management for businesses.

Companies can ensure that financial records are meticulously maintained by engaging external professionals to handle bookkeeping tasks, leading to more precise reporting and decision-making processes.

Outsourcing allows businesses to stay abreast of changing regulations and industry standards without investing heavily in internal training or resources. With stringent security measures, outsourcing partners can guarantee the protection of sensitive financial data, offering a layer of defence against potential cyber threats.

This approach increases data safety and enhances operational efficiency by freeing up in-house resources and time for core business activities, ultimately contributing to more effective financial management strategies.

How Does Outsourcing Bookkeeping Save Time and Money?

The outsourcing of bookkeeping services is a boon for businesses, saving them time and money while enabling a focus on core activities, trimming operational costs, boosting efficiency, and ensuring professional handling of financial tasks.

This strategic approach enables companies to streamline their financial processes, leading to increased accuracy and compliance. By entrusting bookkeeping to experts, organisations can allocate resources more effectively, freeing up valuable time and reducing the administrative burden. Consequently, businesses can channel their energy into strategic decision-making, fostering growth and innovation. The cost-effective nature of outsourcing bookkeeping services helps companies maintain a lean operational structure, ultimately contributing to sustainable savings and profitability.

What Are The Different Types of Outsourced Bookkeeping Services?

Outsourced bookkeeping services come in various types, including virtual bookkeeping, online bookkeeping, remote bookkeeping, and offshore bookkeeping, catering to diverse business needs.

Virtual bookkeeping services are popular for businesses looking to streamline their financial processes without needing an on-site presence. These services utilise cloud-based technology to provide real-time access to financial data, making collaboration and decision-making more efficient.

On the other hand, remote bookkeeping services offer flexibility and convenience, allowing businesses to access professional bookkeeping assistance anywhere in the world.

While cost-effective, offshore bookkeeping services may be more suitable for larger businesses with complex financial requirements due to regulatory and time zone differences.

Virtual Bookkeeping Services

Virtual bookkeeping services offer a cost-effective solution with experienced bookkeepers’ professional expertise, ensuring accurate financial management for businesses.

By utilising virtual bookkeeping services, businesses can benefit from streamlined financial processes, timely reporting, and customised solutions tailored to their needs. These services not only help maintain organised financial records but also improve decision-making by providing valuable insights and analysis. With expert bookkeeping support, companies can focus on their core operations while leaving the financial responsibilities in capable hands. Virtual bookkeepers adhere to high professional standards, ensuring confidentiality, accuracy, and compliance with regulations, thereby safeguarding the financial health of businesses.

Online Bookkeeping Services

Online bookkeeping services leverage cloud-based solutions and automated processes to provide tailored financial solutions supported by experienced teams for efficient operations.

This technology-driven approach allows these services to streamline transaction recording, reconciliation, and financial reporting for businesses of all sizes. By harnessing the power of cloud computing, data can be securely stored and accessed remotely, enabling real-time collaboration between clients and accounting professionals. Automation tools play a pivotal role in improving precision and efficiency by minimising manual data entry errors and expediting laborious tasks. The combination of tailored services and knowledgeable financial teams ensures clients receive personalised support and strategic insights to optimise their financial management.

Remote Bookkeeping Services

Remote bookkeeping services offer seamless integration of technology, scalable solutions, and support business growth by providing efficient financial management services from remote locations.

By leveraging advanced cloud-based software and automation tools, remote bookkeeping services streamline financial processes and ensure real-time access to crucial financial data. The scalability of these services allows businesses to adapt to changing needs and handle larger volumes of transactions without any disruption. This approach enhances operational efficiency and frees up valuable time for business owners to focus on strategic decision-making and driving growth. With the right remote bookkeeping partner, businesses can achieve cost savings, data security, and improved financial transparency, laying a solid foundation for sustained success.

Offshore Bookkeeping Services

Offshore bookkeeping services offer transparent pricing, industry-specific expertise, ACA support, and regulatory compliance to meet the financial management needs of businesses with global operations.

Opting for offshore bookkeeping services grants businesses access to adept professionals well-versed in various industries, guaranteeing accurate financial records and reports tailored to specific sectors. With the assistance of experienced ACAs, companies can navigate complex financial decisions with confidence, knowing they have expert guidance at their disposal. This expertise also extends to regulatory matters, guaranteeing that businesses remain compliant with international accounting standards and local regulations, minimising operational risks and ensuring sustained growth.

How Do You Choose The Right Outsourced Bookkeeping Service Provider?

Selecting the ideal outsourced bookkeeping service provider involves assessing customised packages, flexible solutions, client satisfaction, and the potential for establishing a long-term partnership to meet evolving financial needs.

When evaluating potential providers, looking for one that offers tailored services to align with your unique business requirements is crucial. Feedback from existing clients can provide valuable insights into the provider’s reliability and service quality.

Building a lasting relationship with your bookkeeping partner can ensure continuous support and a deep understanding of your financial situation. This can lead to more effective solutions tailored to your needs and long-term goals.

Determine Your Business Needs

Before choosing an outsourced bookkeeping service provider, evaluate your business requirements, growth strategies, financial health, and need for bespoke solutions.

Recognizing your business’s requirements is paramount as it dictates the level of support needed from an outsourced bookkeeping provider. Assessing your growth objectives allows you to align your services with your long-term goals. A thorough financial analysis ensures the provider can effectively address your specific financial conditions. Tailored financial solutions are essential for catering to your business’s unique demands and successfully implementing growth strategies.

Research and Compare Different Providers

Conduct comprehensive research and comparisons among different outsourced bookkeeping service providers to evaluate their strategic planning capabilities, business performance enhancements, availability of virtual CFO services, and dedicated support options.

This meticulous assessment allows businesses to gain insights into how each outsourced bookkeeping provider’s strategic planning skills align with their unique goals and requirements, ultimately impacting their overall performance.

By delving deep into these service providers’ virtual CFO offerings and analysing the quality of support they provide, companies can make informed decisions that improve financial management and operational efficiency.

Choosing a partner with strong strategic planning capabilities, robust virtual CFO services, and reliable support can drive sustainable growth and success for businesses in today’s competitive landscape.

Check for Certifications and Experience

Verify the certifications and experience of potential outsourced bookkeeping service providers, focusing on aspects like responsive communication, business continuity plans, risk management strategies, and the ability to offer proactive financial solutions.

When selecting outsourced bookkeeping providers, it is imperative to ensure that they possess the necessary certifications and hands-on experience in handling financial matters.

Responsive communication is crucial in maintaining a seamless collaboration between your business and the service provider.

Having robust business continuity plans in place ensures that your financial data is secure and accessible at all times.

Effective risk management strategies are vital to safeguard your finances from potential threats, while proactive solutions can help anticipate and address financial challenges before they escalate.

Consider Reviews and Testimonials

Review client feedback, testimonials, and industry reviews to assess the competitive edge, success rates, profitability enhancements, and vendor management capabilities of potential outsourced bookkeeping service providers.

By delving into client feedback, businesses can gain valuable insights into how well a bookkeeping service provider can align with their needs and goals. Testimonials offer a glimpse into the provider’s track record of delivering successful outcomes and enhancing profitability for other businesses.

Analysing industry reviews can reveal crucial information about the vendor’s reputation, service quality, and ability to adapt to dynamic market demands. This comprehensive evaluation can help select a partner that not only meets but exceeds expectations in terms of efficiency, cost-effectiveness, and overall vendor handling proficiency.

What Are The Potential Risks of Outsourcing Bookkeeping?

Despite its benefits, outsourcing bookkeeping carries potential risks, such as security concerns, confidentiality issues, communication challenges, and language barriers that businesses must address.

Security threats associated with outsourcing bookkeeping are multifaceted, encompassing the risks of data breaches, hacking, and unauthorised access to sensitive financial information. Companies must implement robust cybersecurity protocols, secure data encryption, and access controls to mitigate these risks. Maintaining confidentiality in outsourced bookkeeping processes requires strict non-disclosure agreements and regular audits to ensure compliance.

Communication obstacles and language differences can further complicate the effectiveness of outsourced financial management, leading to misunderstandings, errors, and delays in reporting and decision-making.

Security and Confidentiality Issues

Security and confidentiality concerns in outsourcing bookkeeping services can be mitigated by ensuring compliance, real-time insights into financial data, and implementing time-saving measures.

By adhering to strict compliance protocols, companies can safeguard sensitive financial information and ensure it is handled securely by outsourced service providers. Real-time monitoring tools offer a proactive approach to identifying and addressing any potential breaches, enabling swift intervention to protect data. The integration of automation and digital tools streamlines processes, saving time, and diminishing the likelihood of human error, thereby bolstering data protection and confidentiality in outsourced bookkeeping.

Communication and Language Barriers

Overcoming communication and language barriers in outsourced bookkeeping involves:

- Focusing on core business activities.

- Requesting customised service packages.

- Aligning growth strategies with the service provider to ensure effective collaboration.

Concentrating on core business functions can optimise operations and free up resources for growth initiatives. Tailored service offerings are crucial in meeting specific requirements and ensuring seamless communication between the company and the outsourced provider. Aligning growth trajectories with the service provider fosters a symbiotic relationship where both parties work towards shared objectives and mutual success. Such strategic alignment enhances productivity and paves the way for long-term partnerships built on trust and efficiency.

Lack of Control and Oversight

Concerns over lack of control and oversight in outsourced bookkeeping can be mitigated by implementing transparent pricing structures, fostering responsive communication channels, and establishing business continuity plans for sustained operational support.

Transparent pricing models ensure that clients understand the costs involved, reducing uncertainties and enhancing trust between the company and its clients. Businesses can make informed decisions and avoid unexpected charges by providing detailed breakdowns of services and costs.

Enhanced communication mechanisms, such as regular updates and dedicated points of contact, facilitate seamless information exchange and problem resolution. Developing robust continuity strategies, including backup plans and contingency measures, helps ensure uninterrupted support even in challenging situations.

Hidden Costs and Unreliable Services

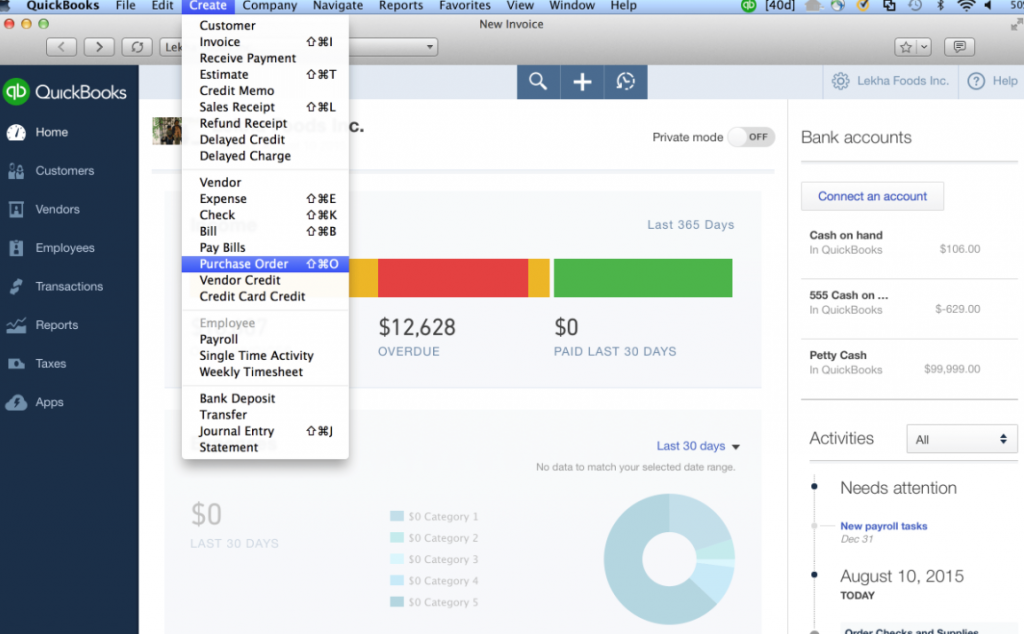

Mitigating hidden costs and unreliable services in outsourced bookkeeping involves partnering with established providers like QuickBooks, Xero, FreshBooks, and Wave Accounting, which are known for their reliability and quality services.These reputable providers are renowned for their robust accounting software and commitment to delivering exceptional service assurance. By collaborating with well-known platforms such as QuickBooks, Xero, FreshBooks, and Wave Accounting, businesses can benefit from streamlined financial management processes and reduced chances of encountering unexpected expenses or service disruptions.